Christian Flanders came away from the US investing championship with a 433% gain on the year of 2024, but he could have made improvements that netted him an additional 170%.

Here’s how he did it.

Christian took time to do a deep dive on his trading stats and found he could increase his reward well over 150% by using trailing stops as his core exit mechanism. (Closing below the moving average).

An absolute bombshell…

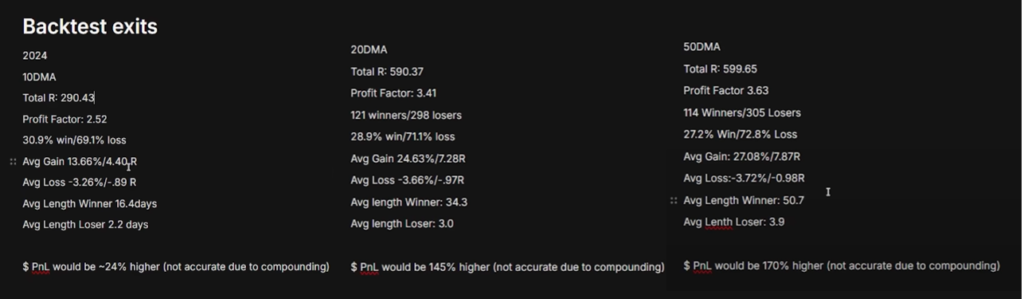

Using the 10 day moving average the reward metric grew from 213R to 290R and from 290R to 590R with the 20 day moving average.

In percent terms, without accounting for compounding (which means these results would in fact be higher in real terms) the 10DMA TS gained 24% account growth and for the 20DMA? 145%

Bet this makes us all consider how we exit positions from here on.

Christian’s current sell rules

Christian sells half into strength after 3 to 5 days of a rally and trails the rest using the 10DMA. This works for entries on pullbacks, breakouts or episodic pivots and helps determine if the trend is still healthy. This selling tactic came from Qullamaggie.

This method’s success stems from capturing the bulk of the move and if trending, letting the winner run for all it’s worth, until it’s not a winner.

Average gain and average time held increase

Using a 10-day moving average as a trailing stop resulted in a potential return of 290R, which is 77R more than the original return of 213R, with a higher average gain and longer average time held for winning trades.

The 10-day trailing stop strategy also resulted in a 24% higher dollar P&L, which does not account for the compounding effect that would have occurred earlier in the year.

Switching to a 20-day moving average as a trailing stop further increased the potential return to 590R, with an average gain of 24% and an average of 34 days for winning trades, compared to 16 days with the 10-day trailing stop.

Christian’s original sell rules

The original return of 213R was achieved without using a trailing stop strategy, and the comparison highlights the potential benefits of incorporating a trailing stop into a trading strategy.

The results are based on real entries and a spreadsheet analysis, which demonstrates the effectiveness of the trailing stop strategy in increasing returns and improving trading performance.

Would it work in real terms?

Christian makes a point here, he couldn’t have held all of his trades for the lengths of time required to achieve these gains. He does say though, with full margin it may be possible. This is because of capital restrictions and position size, there’s only so many trades we can be in at any one time.

He notes in the interview, he would still be in Rocket Lab and Reddit which have performed exceptionally well (Feb 2025) and these potential gains would have made massive progress for his account.

But, emotionally handling these stocks as price action dances above the moving averages is a tough job for anyone. Th profit volatility in these names can be extreme, and when these names pullback, they all pullback simultaneously.

You could easily see a 30% drawdown in open profits and most people cannot handle that kind of situation. Christian admits he couldn’t either, not for lack of trying but he’s more comfortable with tighter reins on his open profits.

He says there’s no chance he could hold down to the lows of the fifty day, he’d likely sell on the pullback at the lows instead.

You’ve got to be able to stomach large drawdowns.

Leave a Reply