Christian Flanders became the second place winner in the USIC championship of 2024 with an incredible 433% total return for the year. He recently had an interview with Richard Moglen which detailed his journey from poker player to seasoned trader.

Here are the notes distilling this interview down to actionable tips, reminders and essential foundations of trading that Christian utilised to achieve his triple digit returns in 2024.

For the concise version of these notes, click here.

Christian’s start in poker and trading parallels

Christian found Poker tournaments setting up across his campus as the game became extremely popular. Noticing the players online were not very skilled, Christian set about increasing his skills and knowledge through reading and practice, eventually building up enough capital to pay for his senior year of college. The experience and skills gained from online poker had a lasting impact.

Poker statistics and emotions

After leaving college, Christian joined a prop trading firm, this didn’t last long though as he made more from his poker earnings than from his salary. So despite the guaranteed income, he left his job in the prop firm to play poker full-time.

Over the ten years of full-time poker, Christian utilised software to track the hands of opponents, allowing for data analysis to improve his gameplay. He studied the best players and focused on areas of improvement to tweak and optimise his playing style.

The mental aspect of poker proved to be a significant challenge. Emotions can intensify when money is involved, leading to issues like tilt and a strong dislike for having a losing session, often resulting in extended playing sessions to try and recover losses.

Not unlike trading right?

He found the solution was to quit the session, even when losing; this crucial skill improved his level of skills as he found continuing to play while tired or on tilt led to poor decision-making that set him back.

Key similarities between poker and trading

Trading and poker share similarities, particularly when it comes to managing emotions and dealing with money at risk; both activities involve uncertainty and the potential for significant financial losses.

In poker, players can observe their opponents’ betting patterns and body language to gauge their emotional state, but in trading, it’s more challenging to manage emotions due to the prolonged nature of trades, which can last from hours to months.

The uncertainty of trading outcomes can be difficult to cope with, as humans crave control and certainty, but in trading, the only aspects that can be controlled are the entry and exit points, while the stock’s movement is beyond control.

The key similarities between trading and poker are the need to manage emotions and the presence of mind to focus on money at risk.

If left unchecked, both can lead to impulsive decisions and a loss of control.

Boom-and-bust traders and risk-averse traders

There are two types of traders: boom-and-bust traders and risk-averse traders, and it’s possible to be profitable with either approach, but the boom-and-bust style resulted in Christian giving significant gains back to the market early on in his trading journey.

He had to refine his system.

Boom and bust without risk management wouldn’t cut it.

The transition from playing no-limit hold’em to pot-limit Omaha poker required adapting to smaller edges, which involved betting aggressively to maximize wins, even with a slight edge, such as a 53% chance of winning.

Christian initially applied this aggressive betting strategy to trading, but he didn’t account for the varying win rates and risk multiples in different market conditions, leading to large drawdowns when bet sizing was too large.

In poker, if you are holding aces you have an 80% chance to win, in trading that’s just not the same. He believed each setup was the same, he was going to plough in and go for it each time but trading is more nuanced than that. The variables that make a successful trade are numerous and subtle.

How did he make it through?

The progression over eight years involved learning to analyse trading performance, identifying key turning points, and unlocking the next level of performance through lessons learned, with a crucial realization being the importance of managing risk.

Risk, risk risk.

Boom and bust cycles: The struggle to control drawdowns

Unlike trading at firms or private hedge funds, trading on one’s own means there is no one to intervene or provide guidance when taking excessive risks. When trading alone, it can be difficult to close a large position, especially when emotions are involved, making it hard to think clearly.

The concept of edge is simpler in poker, where it means consistently getting money in when you are mathematically ahead of one’s opponent. In trading, defining edge is more complex, and one approach is to keep trading as simple as possible.

K.I.S.S — Keep it simple, stupid

The struggle to control drawdowns is a significant challenge, as losing almost all of one’s money and having to start over can be emotionally frustrating. Controlling drawdowns is key, and this can be achieved through position sizing and progressive exposure, which is essentially an anti-martingale strategy.

An anti-Martingale strategy involves increasing bet size when winning and decreasing it when losing. Trade small when you’re losing, trade large when you are winning. (KISS)

Christian’s trading philosophy

The goal is to get on the fastest-moving stocks going up and stay on for the ride, which requires position sizing and knowing when to bet.

In trading, the biggest opponent is oneself, and the challenge is to make decisions without hesitation, regret, fear, or emotions. Traders are fighting with is themselves, and they need to be able to make decisions without emotions.

Christians own journey involved learning from various trades, including big gainers and big losers, which helped refine his strategy.

He also had to learn that poker is a relative skill game, where a player’s skill is compared to others, whereas trading is an absolute skill game, where the trader’s skills are tested against the market. The markets involve many more factors than poker, including environment, individual stocks, and timing, making it a more complex game.

Learning from trades that cost you big gains

The worst trade ever was a result of breaking a rule and not having a stop, which is a mistake that can cost traders everything, and this experience keeps traders humble and on their toes.

The market has a way of punishing consistent mistakes, and it’s only a matter of time before they cost traders significantly.

From Business Insider Article:

On February 5, 2018, he bought multiple shares of SVXY totalling 3,000 at an average split-adjusted price of $67. It had been on a strong uptrend over the previous two years. The fund was down sharply that week. Flanders saw it as a chance to get in cheap with the assumption it would recover. But it never did. He sold at an average split-adjusted price of $35, according to his brokerage statement. That’s when he learned his biggest lesson: that managing his emotions was 95% of the process.

“Your emotions are going to make you do the wrong thing at exactly the worst time,” Flanders said. “You’re going to panic-sell at the lows; you’re going to panic-buy at the highs. You’re going to trade when the stock is zigging and zagging and get chopped up. When the stock finally breaks out, you’re going to short it. When the stock finally breaks down, you’re going to buy it.”

Remember you can lose everything in one trade, without risk management.

Christians trading statistics

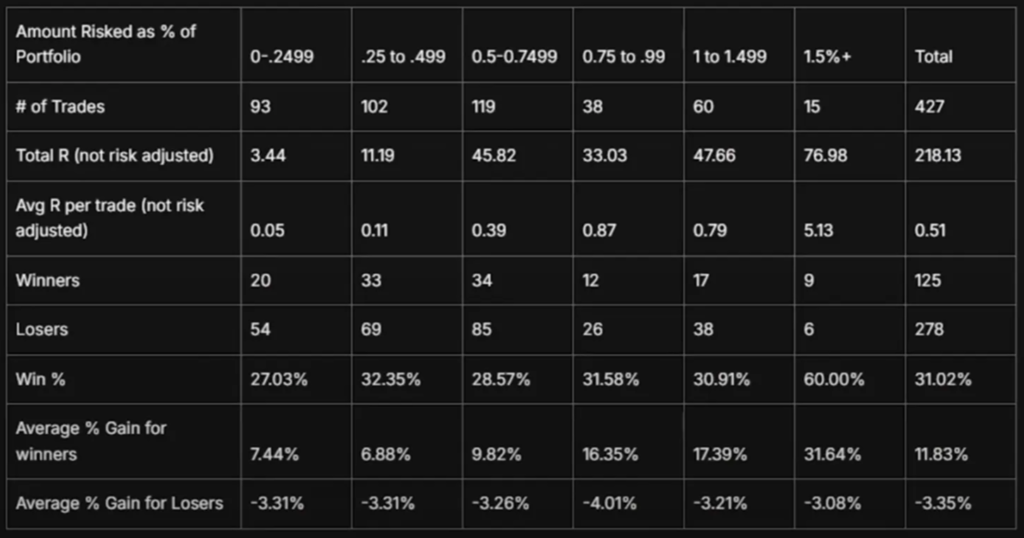

The provided statistics for 2024 show the average numbers, including the average R per trade, win percentage, and average gain, broken down by risk, highlighting the impact of sizing up on trades with conviction.

The statistics demonstrate that the most impactful trades are those where more is risked, and that sizing up with conviction is crucial for achieving large returns.

Identifying A star setups

To identify A+ setups, it is necessary to trade diligently for an extended period, recording every trade, studying past model stocks, and constantly learning. Christian maintained a comprehensive notebook, containing data on hundreds of stocks reviewed from the 1930s onwards to analyse what works and what doesn’t in the stock market.

The process involves going back in time, doing deep dives, and analysing past market trends to gain conviction in sizing up and holding through inevitable pullbacks.

An easy method to find stocks to review is by using Twitter. Many traders share their charts, identifying stocks that have gone up the most, then you can analyse them on TradingView.

The analysis involves looking for specific patterns such as VCP (Volume, Confirmation, and Price), power plays, and episodic pivots in the charts of winning stocks. The process of reviewing stocks is time-consuming but worth it, as there are no shortcuts to achieving significant returns in the stock market.

When analysing individual stocks, the goal is to learn something that can be applied to future investments by identifying key patterns and trends.

Keep it simple.

Adjusting position sizing based on market conditions

Adjusting position sizing based on market conditions can significantly impact trading results. Position sizing plays a crucial role in managing risk, and capping monthly losses can help prevent significant drawdowns, as demonstrated by Mark Minervini’s approach to stop losses in his books.

Capping monthly losses can help traders avoid significant drawdowns, and using a smaller position size can make it easier to handle larger losses, but it’s essential to find a balance between risk management and potential returns.

Mark Minervini’s approach to risk management, which involves sizing much smaller, can help traders avoid double-digit losses and achieve more consistent results.

The end of part one

This is the end of part one of Christian Flanders interview notes. You can subscribe to be notified of when part two is out, and subsequent posts. Before we leave it there, here are Christian’s Book Recommendations.

Christian’s Interest in trading was first sparked in high school after reading books — Two influential books “How to Make Money in Stocks” and “Reminiscences of a Stock Operator”, with the latter being particularly loved for its incredible story and timeless relevance.

Leave a Reply