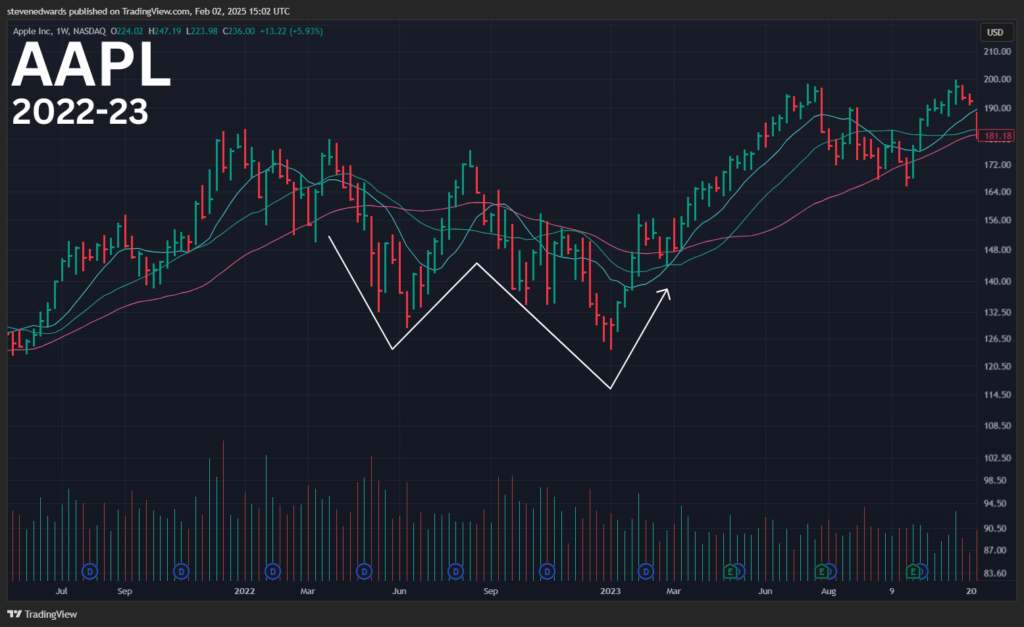

The double bottom pattern is less common than the cup and handle, though it appears from time to time. It tends to show up more frequently near correction lows and sometimes forms with a handle.

A sharp “W” shape forms, with the right side of the W typically undercutting the left before rising again. Unlike a cup with handle pattern, this formation shouldn’t be rounded. When the right side fails to undercut the left, the dip may not be deep enough to shake out weak stockholders, increasing the risk of pattern failure.

The double bottom’s buy point is flexible. On extended double bottoms, you can draw a downtrend line to catch an early entry. The standard buy point occurs at the top of the middle peak, extended to the right. When the price moves through that point with heavy volume—40% above average—that’s your entry signal.

Leave a Reply