William O’Neil, the legendary investor who founded Investors Business Daily and the exceptional CANSLIM trend-following strategy made his life’s work available to the public through investors.com and his famous book, “How to make money in stocks”.

It started with his career in stock-broking in 1958 and quickly accelerated with him and his team’s studies of the most successful stocks — he pioneered the use of historical price action alongside fundamental and technical analysis to find the most effective trend trading methods, rules and systems that have stood the test of time, over many, many market cycles.

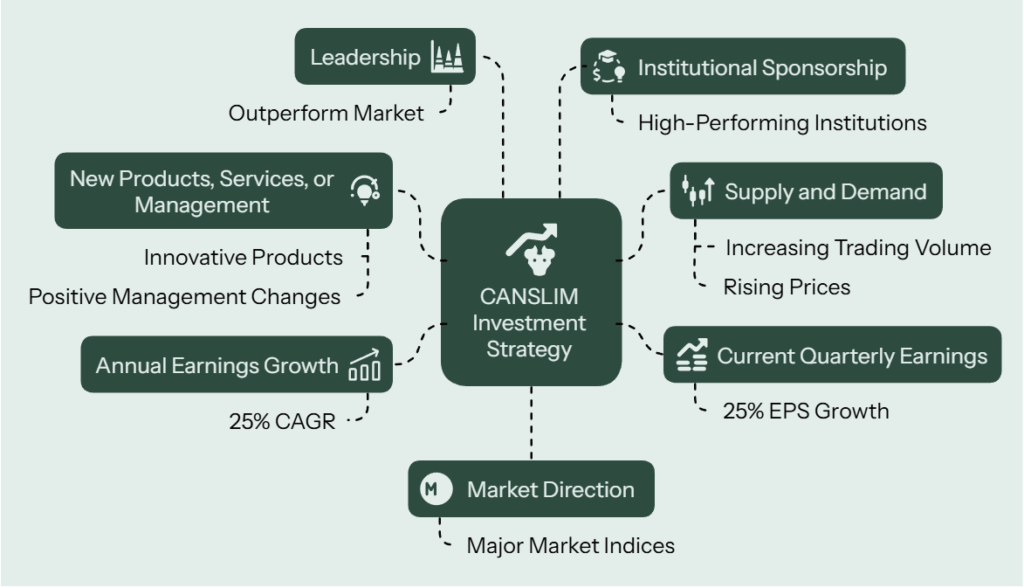

From this research, Bill O’Neil created the CANSLIM investment discipline, which identifies the seven key factors present in top-performing stocks during bull-markets and bear-markets. We’ll get onto that later.

His work grew from an obsession with the stock market into a determination to teach inexperienced traders and even those who know a thing or two, how to exponentially develop their potential and become exceptional stock market traders.

Successful traders follow William O’Neil’s Canslim

Traders who built their strategies around William O’Neil’s Canslim investing system often enter the US Investing Championship, and many have one the annual competition with account growth’s of many multiple 100%. Notable stock traders who have won the competition or come close are Oliver Kell, with 941% account growth in 2020 and Matt Caruso with 346%.

Learn from the best, perform at your best.

William O’Neil’s Achievements

O’Neil’s career achievements include becoming the top-performing broker at his firm early in his career, purchasing a seat on the New York Stock Exchange at the age of 30 (the youngest person to do this at the time) and in just 26 months, O’Neil’s personal account grew 20-fold through trading the canslim investing system he was developing.

O’Neil founded William O’Neil + Co in 1963, one of the company’s lesser known achievements was managing money for the Vatican — he then launched Daily Graphs in 1972 (which has evolved into an ultimate resource for individual investors, now called Market Surge) and finally he founded Investor’s Business Daily (IBD) in 1984.

He made many friends during his life, notably his team at IBD and the numerous investors who attended his seminars about all things investing and Canslim.

William O’Neil’s defining Canslim trades

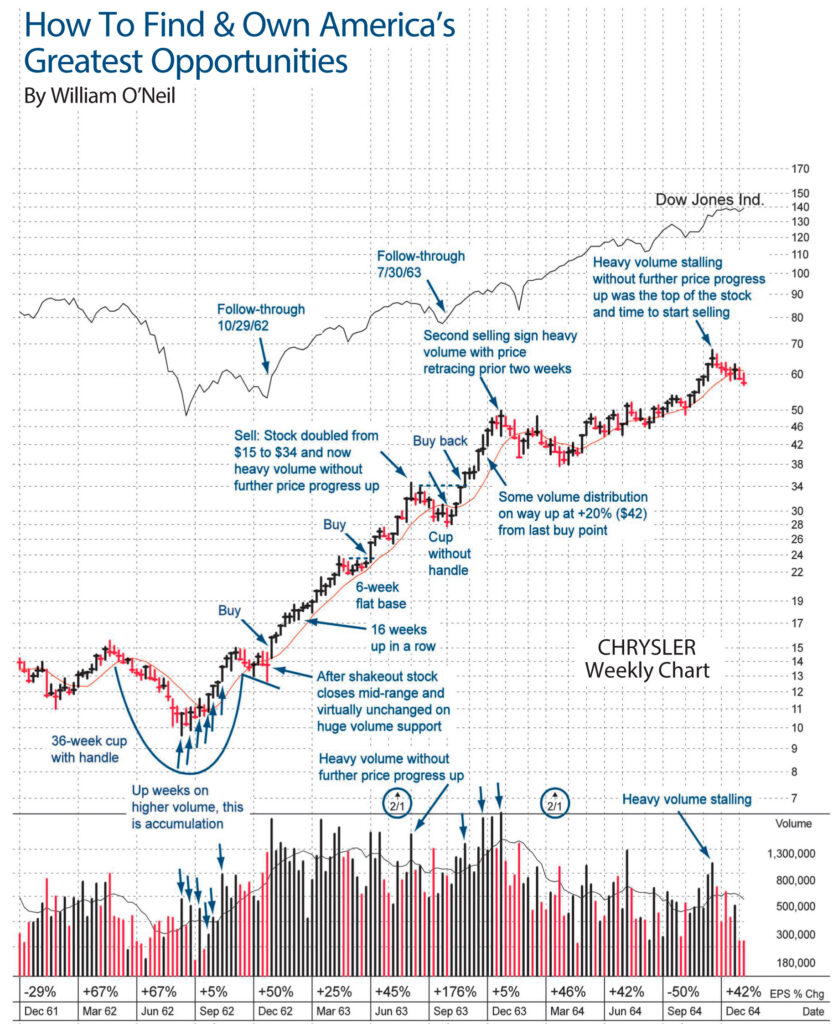

One of the most defining trades for William O’Neil was his Chrysler trade.

He started entering the stock at around $15 and added numerous times from $24 to $34 and sold on the way up when his signals told him to. One signal was when there was heavy volume but no further price action higher, this told him Chrysler needed time to set up again. Chrysler eventually hit $68 when heavy volume came in once gain, without further price progress higher.

William O’Neil created many model books of the greatest stocks in America’s history. You can find the PDF of these online by searching “How to find & own America’s greatest opportunities pdf”. A great resource to study while learning to recognise bases and price action following the Canslim strategy.

The O’Neil Canslim Strategy

O’Neil studied the greatest stocks of his time and found those with strong earnings and sales growth, often trading at high valuations, were the best stocks to trade while the market trend was working in his favour.

The Canslim strategy consistently outperformed the market — the method combines fundamental and technical analysis to identify high-potential stocks. This approach has been validated time and time again through traders performance who use his trading system as the bedrock of theirs.

As you can see below there are various elements that make up the trading system, each one narrows down your field of potential stocks to find the best potential trades.

I will update this page with links to an in-depth guide on the Canslim trading method shortly. For now, here’s a short description of how to implement the trading strategy and some of the trading method’s pros and cons.

How to implement the Canslim strategy

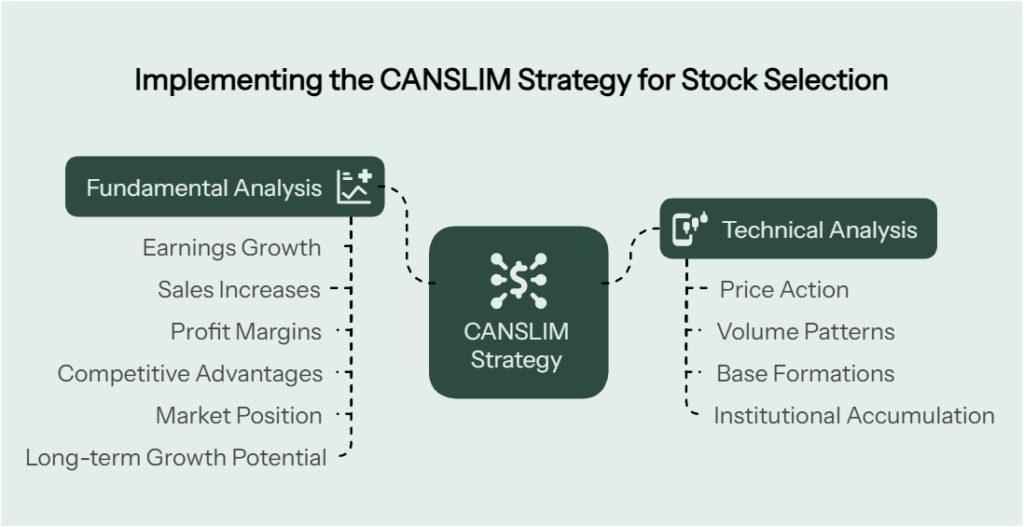

Implementing the CANSLIM strategy requires a systematic approach beginning with comprehensive screening for stocks that satisfy both fundamental and technical criteria. Start by analysing company financials, with particular focus on accelerating earnings growth, robust sales increases, and expanding profit margins that indicate business strength.

Next, evaluate the company’s competitive advantages, market position, and long-term growth potential, prioritizing innovators in leading industries. Once potential candidates are identified, examine price action and volume patterns to pinpoint optimal entry points, looking specifically for constructive base formations with signs of institutional accumulation.

Finally, and critically, assess the overall market direction before committing capital, as even the strongest stocks typically struggle during bearish market conditions. This disciplined process helps investors identify high-potential growth stocks poised for significant price appreciation.

- Screen for stocks meeting CANSLIM criteria using fundamental and technical analysis tools.

- Analyse company financials, focusing on earnings growth, sales growth, and profit margins.

- Assess the company’s competitive position and growth potential.

- Identify potential buying opportunities by analysing price and volume trends.

- Consider overall market trends before making investment decisions.

Advantages and Considerations for the Canslim Strategy

If you’re unsure on whether Canslim is the investing method for you, think about how your personality would fit with the investing style. Some people would like a more active investing system, whereas others want a hands free method.

Canslim traders can be extremely passive, only working on their investing system on the weekends, whereas others are active throughout the week. There are more pros and cons to this system as you can see below.

Advantages:

The Canslim strategy excels by combining robust fundamental analysis (earnings growth, innovation, institutional backing) with disciplined technical analysis (supply-demand indicators, relative strength, market timing) to identify high-potential growth stocks.

This method has consistently identified market leaders across decades, from Home Depot to NVIDIA, while its emphasis on market conditions and industry leadership provides built-in risk management that helps investors avoid major declines while capturing substantial upside during strong markets.

- Potential for high returns by focusing on strong growth stocks.

- Combines fundamental and technical analysis for a comprehensive approach.

- Emphasizes market trends and industry leadership.

Considerations:

CANSLIM demands consistent commitment, essentially functioning as a part-time job with requirements for market analysis, chart monitoring, and immediate execution when conditions change.

Its concentration in high-growth stocks creates inherent volatility risk, particularly during sector rotations or market corrections, while its effectiveness significantly diminishes during bear markets or sideways trading environments.

- Requires active management and continuous monitoring.

- May involve higher risk due to focus on growth stocks.

- Effectiveness can decrease in bear markets.

The Most Important Canslim Factor: Risk Management

CANSLIM emphasizes cutting losses at 7-8% below the buy point to minimize losses and preserve gains. This stop-loss strategy is crucial for managing risk in volatile growth stocks.

In conclusion, CANSLIM offers a structured approach to growth stock investing. While it has the potential for significant returns, it requires diligent research, active management, and strict adherence to risk management principles.

Leave a Reply